Comparing National Positions on Military Exports to Saudi Arabia

Saudi Arabia is the world’s largest importer of weapons and the global north—in particular, the United States, the United Kingdom, and France—its main supplier. And this trade is growing. According to the Stockholm International Peace Research Institute (SIPRI), Saudi arms imports for the period 2016-2020 were 61% greater than imports for the prior five-year period.

Since a Saudi-led coalition intervened in the civil war in Yemen in 2015 and Saudi agents assassinated journalist Jamal Khashoggi in 2018, many arms-exporting countries have cut or cancelled weapons transfers to the Saudi government and military. All cite the threat that Saudi security forces or co-belligerents could use the weapons to facilitate human rights violations, particularly in Yemen.

However, only Norway and Denmark have ended all weapons transfers to Saudi Arabia. Some countries, like Italy, export only certain types of weapons; others, like Germany, permit the transfer of certain subcomponents. Sweden has approved recent arms exports despite a national regulatory position explicitly forbidding such action.

CANADA’S POSITION

The government of Canada routinely claims to have one of the most robust arms control regimes in the world. However, the war in Yemen, the assassination of Jamal Khashoggi, and Saudi Arabia’s deeply concerning domestic human rights record have had no material effect on Canada’s supply of weapons to the Saudi government. Canada continues to transfer to Saudi Arabia weapons worth billions of dollars, in clear contravention of its obligations under the Arms Trade Treaty (ATT) and the Export and Import Permits Act (EIPA).

Canada has exported weapons to Saudi Arabia since the early 1990s. Most systems have been light armoured vehicles (LAVs) produced by General Dynamics Land Systems-Canada. In 2014, Canada announced a $14-billion deal with Saudi Arabia for hundreds of LAVs. Although the arms deal is the biggest in Canadian history, most details of the arrangement have never been made public.

Following Khashoggi’s death, Canada did implement a freeze on the issuing of new arms export permits to Saudi Arabia while an investigation was conducted into the likelihood that such transfers would breach Canada’s export controls. Permits approved prior to the freeze, including those for hundreds of combat-ready LAVs, continued to be processed. Canadian arms transfers to Saudi Arabia more than doubled during this period.

Following the investigation, the government of Canada released its Final Report: Review of export permits to Saudi Arabia in April 2020. The report argued that there was no substantial risk that Canadian weapons would be used to violate international humanitarian law or international human rights law, or to facilitate gender-based violence or other abuses. Therefore, Canadian arms exports to Saudi Arabia were permissible. Canada then began approving new arms export permits to Saudi Arabia.

For two years in a row, the UN Group of Eminent Experts on Yemen has identified Canadian arms exports (as well as those of the United States, United Kingdom, France, Iran, and Italy) as a direct contributor to the destructive war in Yemen, which has now been active for over seven years. In a joint report released this summer, Amnesty International and Project Ploughshares found that the conclusions of Canada’s April 2020 assessment were flawed and incompatible with Canada’s domestic and international arms control obligations. Yet Saudi Arabia remains the top non-U.S. destination for Canadian weapons, by a wide margin.

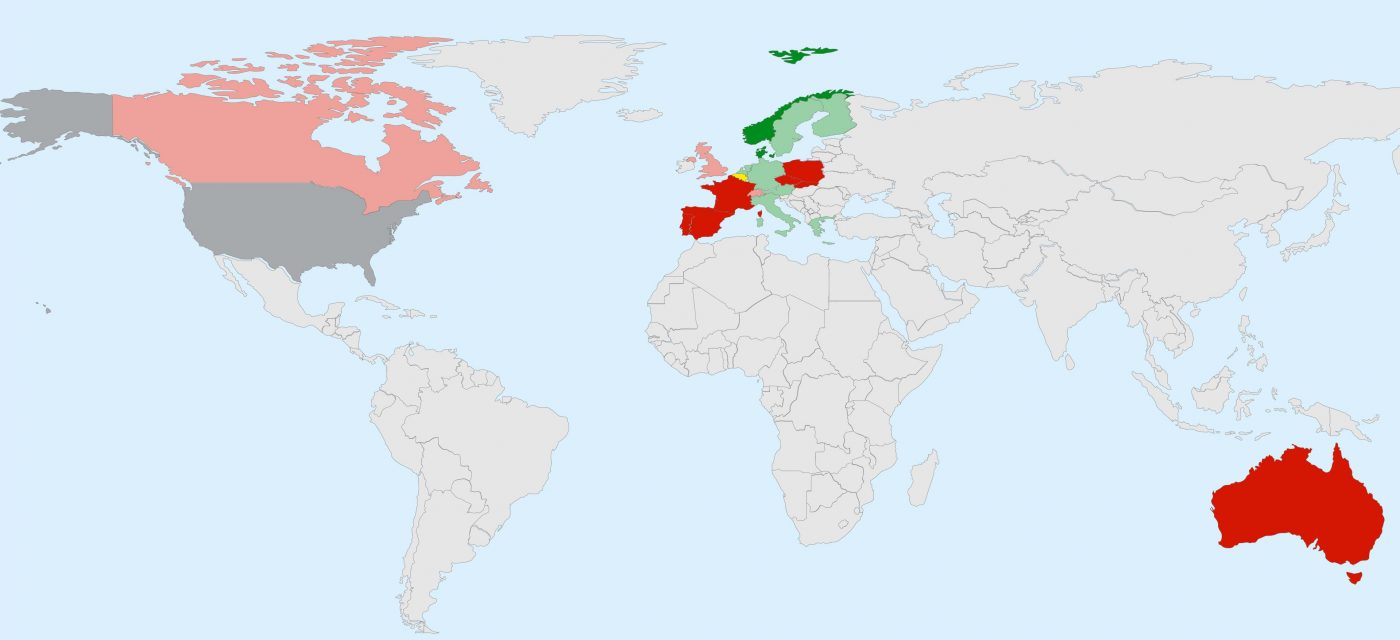

PLOTTING NATIONAL POSITIONS

What follows is a non-exhaustive comparative analysis of national positions on arms exports to Saudi Arabia. With the exception of the United States, all countries included are states parties to the ATT and therefore face the same obligations that Canada does to ensure that weapons exports do not contribute to human rights abuses. Comparing Canada’s position to that of these like-minded states should provide a sound basis for further analysis of Canadian arms controls.

Data was collected in August and September 2021 from open sources, including government documents, media reports, and arms trade monitors. Data for EU Member States and the United Kingdom was collected, in part, via the European External Action Service (EEAS) online database. Permit and export values, if available, were reported in the currency used in the original source, generally that used by the reporting country or body, unless otherwise indicated.

The countries examined either have some national regulatory position on arming Saudi Arabia or have permitted exports of military goods valued at more than €1-million to Saudi Arabia during the period under analysis. States included that do not report individual export values, such as Australia, were estimated to have exceeded €1-million in export permit approvals since 2017, based on available information. This review does not include all parties that have exported weapons to Saudi Arabia.